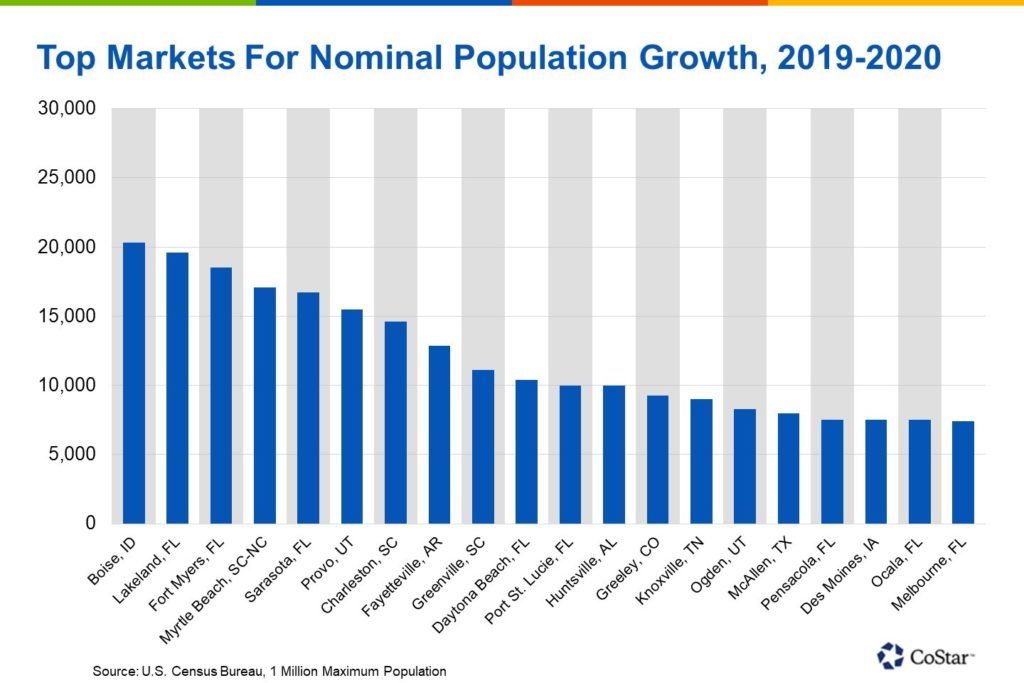

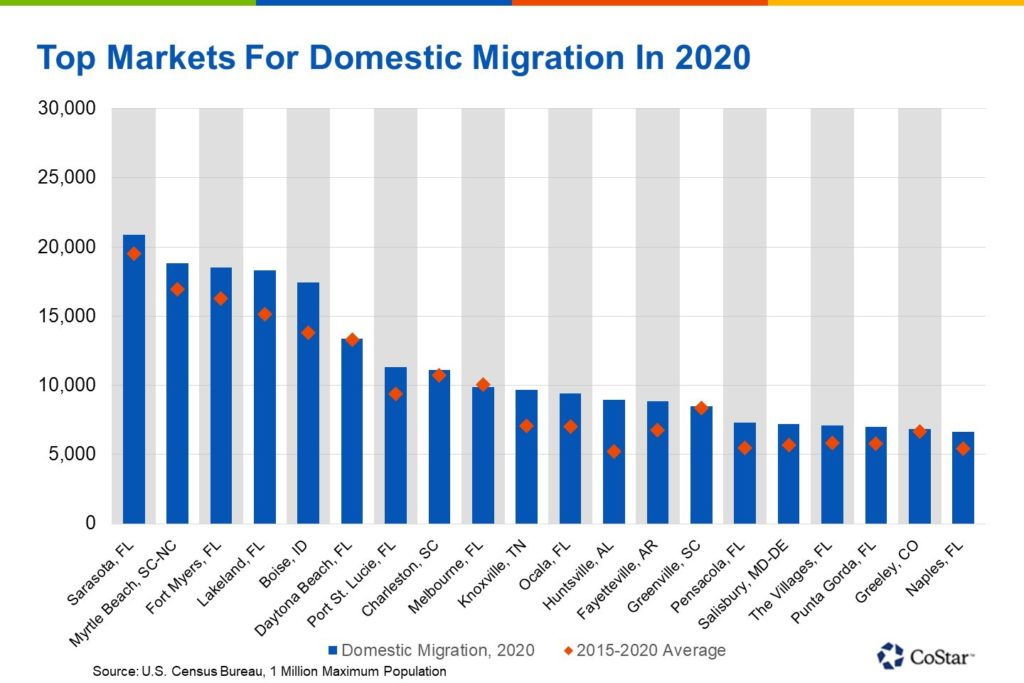

Small and mid-sized cities (defined as those with populations less than 1M people) are seeing population growth in excess of 5-year averages that indicate the pandemic is the driving cause, Costar Analytics team David Kahn, Jessica Morin, and Same Tenenbaum reports. Population changes are catching the attention of commercial real estate investors in these cities.

Who is moving?

It’s not all retirees headed south. “‘Cities are adding jobs in the medical, retail, and industrial sectors to support increased consumer spending levels,'” according to Brian Alford. Tourism is another factor driving this increase in consumer spending and bringing wage earners to these areas.

Where are they moving?

Commonalities between the small and mid-sized cities seeing this growth are their affordability, lower taxes, better weather, and job opportunities. In fact, 14 of these top 20 fastest growing small and mid-sized cities are located in the southeast, with 8 of them located in Florida.

What does the pandemic have to do with it?

The lack of large institutions and universities, air and transit accessibility, and major corporations are typical downsides of these smaller cities, but thanks to the pandemic and the rise in remote work, these downsides are mitigated in favor of a lower population density.

Is this a good thing?

Yes. Many of these cities are solely dependent on domestic net migration, due to negative population growth when looking solely at deaths outpacing births and international migration.

What does this mean for investors?

While commercial real estate investors have been enthusiastic surrounding these markets with often higher returns, they are still considered risky due to a lack of liquidity driven by size, inaccessibility, and unfamiliarity. Blue Ridge Realty specializes in commercial real estate in Knoxville, TN, the city ranking #10 for domestic migration and #14 for nominal population growth. Contact us today to find out about commercial real estate investment opportunities in the area.